- #How to delete intuit mint account how to

- #How to delete intuit mint account generator

- #How to delete intuit mint account pro

- #How to delete intuit mint account free

#How to delete intuit mint account pro

Surprisingly, you don’t have to hire a pro to make a financial plan. I also took care of other important business, such as making a will and getting adequate insurance. Budgets and financial plans work best together, but each serves a different purpose. In general, a budget serves to track cash flow and prevent overspending, whereas a financial plan is a written report that outlines your short- and long-term financial objectives and priorities and sets out a path to achieve them. Research shows that 50% of Canadians don’t have a financial plan, which is shocking.Įveryone needs to make a financial plan – regardless of your age, income, or employment status. Based on my experience, here are a few alternatives to budgeting with : Make A Financial Plan So whether you’re looking to get out of debt, track your cash flow, or save for a specific financial dream (like a house or vacation), a budgeting app like, YNAB, or PocketSmith can help you get to where you want to be.īut it didn’t work for me, so I took a long, hard look at my financial strategy and tweaked it. According to YNAB (You Need a Budget), new YNAB users save on average $600 by month two and more than $6,000 their first year (!). I also read some articles about some concerns about (and other apps and tools that access your information), so I decided to shut it down.ĭon’t get me wrong – a budgeting app can be an amazing tool that can help you achieve financial freedom.

#How to delete intuit mint account how to

I moved beyond budgeting to looking at other financial factors too, such as how to start investing, whether to contribute to a TFSA or RRSP, and buying a house.

After establishing my career and paying off my student loans, I didn’t need to live as frugally. I needed a more flexible tool to fit with my family’s finances. One month, I might be making five-figures, whereas another might bring $1000. It was exhausting, and for us, it wasn’t making a difference for our spending.īut the biggest reason for quitting ? My financial circumstances didn’t fit with this budgeting app.Īs a freelancer, my monthly earnings fluctuate from month-to-month and trying to stick to a set-in-stone budget just isn’t doable. So I’d have to correct mistakes and be extra diligent about reviewing the numbers.

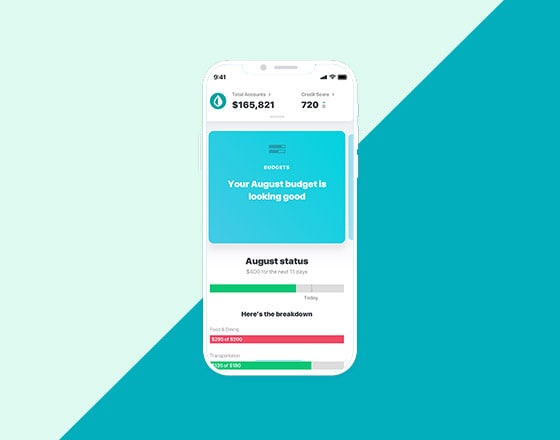

Sometimes got things wrong too, by misclassifying or duplicating transactions. I Just Outgrew įor one, I found the app rather time-consuming: I’d spend an hour a day scrutinizing every financial transaction. The app even sent reminders to pay my bills on time! But eventually, it wasn’t enough. It helped me make a budget (displayed in a colourful pie chart), track my cash flow, and monitor my credit score and savings. I managed my money from one dashboard, linking my bank accounts, mortgage, credit cards, PayPal, and savings accounts to the app.

#How to delete intuit mint account free

At first, gave me everything I needed: a free and simple budget tool that I could use on my computer or phone. This year, I broke up with my budgeting software. For complete and current information on any advertiser product, please visit their Web site. LOANS ARE ARRANGED THROUGH 3RD PARTY LENDERS.Advertisers are not responsible for the contents of this site including any editorials or reviews that may appear on this site. NO MORTGAGE SOLICITATION ACTIVITY OR LOAN APPLICATIONS FOR PROPERTIES LOCATED IN THE STATE OF NEW YORK CAN BE FACILITATED THROUGH THIS SITE. THIS SITE IS NOT AUTHORIZED BY THE NEW YORK STATE DEPARTMENT OF FINANCIAL SERVICES. INFORMATION RECEIVED WILL BE SHARED WITH ONE OR MORE THIRD PARTIES IN CONNECTION WITH YOUR RESIDENTIAL MORTGAGE LOAN INQUIRY.

#How to delete intuit mint account generator

CFL License #60DBO-116115 | License and disclosure | NMLS Consumer Access LEAD GENERATOR ONLY, NOT ACTING IN THE CAPACITY OF A MORTGAGE LOAN ORIGINATOR, MORTGAGE BROKER, MORTGAGE CORRESPONDENT LENDER OR MORTGAGE LENDER. In California loans are made or arranged by Intuit Mortgage Inc. (CFL #6055856) | Licenses The Mint Mortgage experience is a service offered by Intuit Mortgage Inc., a subsidiary of Intuit Inc, NMLS #1979518. In California, loans are made or arranged by Intuit Financing Inc. ( NMLS #1136148), a subsidiary of Intuit Inc. Intuit Personal Loan Platform is a service offered by Intuit Financing Inc.

0 kommentar(er)

0 kommentar(er)